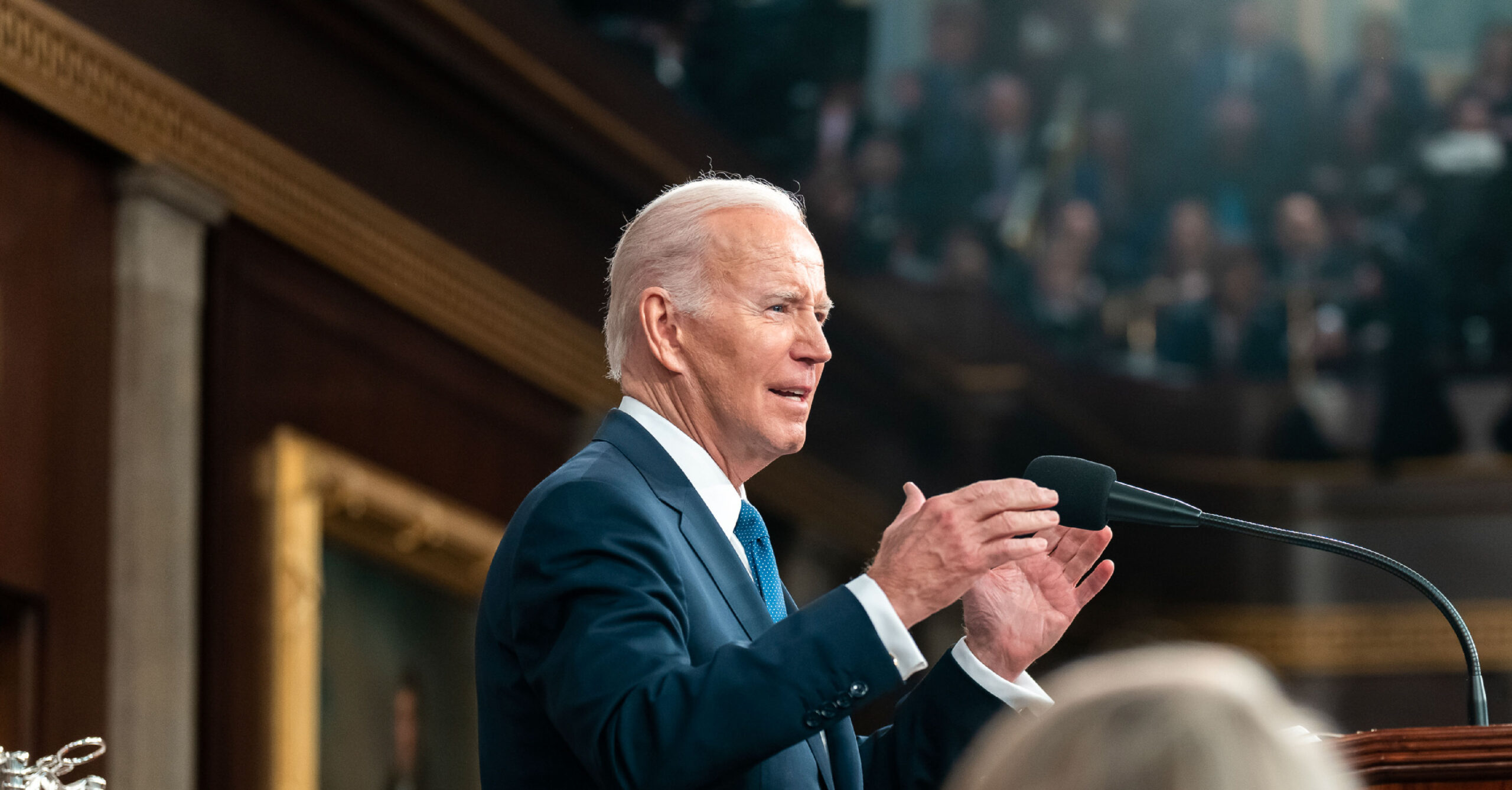

Despite Progress Made By President Biden, the GOP is Putting LBGTQI+ Rights At Risk

Lowering drug costs, expanding affordable health insurance coverage, and banning health care discrimination are critical to improving access to comprehensive, high-quality health care and – together with other actions – advancing health equity for lesbian, gay, bisexual, transgender, queer, and intersex (LGBTQI+) people in America. The Biden-Harris administration has been leading the way in ensuring LGBTQI+ individuals have access to health care, while Republicans continue to sabotage LGBTQI+ rights in state legislatures by denying transgender youth access to gender-affirming care, and the ability to use chosen names and pronouns in schools, and banning drag as a form of gender expression. Policies to improve access to care and protect LGBTQI+ individuals from discrimination in health care and other settings are essential for improving the health and well-being of LGBTQI+ people nationwide.

However, Trump-appointed MAGA judges are setting a dangerous precedent to pull vital medications off the market and eliminate no-cost preventive services that LGBTQI+ people count on to stay healthy — including PrEP, a medicine that is 99 percent effective at preventing the spread of HIV and can cost thousands of dollars annually. This threatens to exacerbate health disparities in queer Black and Hispanic/Latino communities. Republicans in 10 states continue to block Medicaid expansion, while the program provides critical health care access for LGBTQI+ people. Meanwhile, state-level Republicans are igniting a war on trans health care, with Florida Republicans banning upwards of 80 percent of all gender-affirming care in the state. Whether it’s barring no-cost screenings or preventive medicine, banning gender-affirming care, or attacking other fundamental LGBTQI+ rights, Republicans’ war on LGBTQI+ health care is only getting worse.

The Biden-Harris Administration Is Helping Millions of LGBTQI+ Americans Gain Health Coverage

Expanding Health Coverage For Millions Of Americans. Premium subsidies for people who purchase coverage on their own made available by President Biden’s American Rescue Plan helped nearly 210,000 LGBTQI+ enrollees have access to zero-premium plans. Nationwide, 20 percent of Black LGBTQI+ individuals are uninsured, compared to 15 percent of Black heterosexual and cisgender individuals and 9 percent of non-LGBTQI+ individuals overall. Before the Affordable Care Act (ACA) went into effect in 2013, 34 percent of LGBTQI+ Americans were uninsured. As of June 2020, the uninsurance rate amongst LGBTQI+ individuals dropped to 16 percent. In the 2023 Open Enrollment period, a record-breaking 21.3 million Americans signed up for health insurance through the ACA, a 17 percent increase from 2022.

Reversing Trump Policy Allowing Sexual Orientation Discrimination. In May 2021, Department of Health and Human Services (HHS) Secretary Xavier Becerra announced that sexual orientation would be restored as a protected class under the ACA. In July 2022, HHS put forth a proposed rule implementing Section 1557 of the ACA, which prohibits discrimination on the basis of race, color, national origin, sex, age, and disability in certain health programs and activities. The rule affirms protections against discrimination on the basis of sex, including sexual orientation and gender identity consistent with recent U.S. Supreme Court decisions. In April 2024, this rule became finalized and ensures that LGBTQI+ individuals aren’t denied coverage or charged more for care. This Administration’s policy reversal has been especially important with transgender rights being attacked by Republicans. These new protections are already under attack with the state of Florida suing the administration to overturn the rule.

Closing The Coverage Gap Improves Outcomes For LGBTQI+ Individuals. As of June 2022, 1.2 million LGBTQI+ Americans were covered by Medicaid, and of those nearly 13 percent identified as transgender. According to a Center for American Progress survey, in 2019, the LGBTQI+ uninsured rate was 20 percent in the states refusing to expand Medicaid, compared to 8 percent in states that adopted Medicaid expansion. 29 percent of LGBTQI+ individuals faced difficulty seeking medical care when sick or injured due to cost. LGBTQI+ Americans are twice as likely to be without health insurance. Closing the Medicaid coverage gap is the single most important policy to expand coverage and reduce racial and ethnic inequities in the American health care system, and is an important policy solution for LGBTQI+ people because of the intersectional dimensions of their identities. A 2022 study found that more Black LGBTQI+ adults had Medicaid as their primary insurance compared to their heterosexual and cisgender counterparts.

Biden-Harris Administration Helps LGBTQI+ Americans Age With Dignity

Millions Of LGBTQI+ Americans Able To Grow Old At Home. Federally provided home- and community-based services funds helped more than 100,000 individuals return to their homes and communities from nursing facilities between 2008 and 2019. Allowing LGBTQI+ seniors to grow old at home helps alleviate the concern older LGBTQ+ adults have about being neglected or abused, or facing discrimination in nursing homes or assisted living facilities. In President Biden’s fiscal year 2024 proposed budget, $150 million is dedicated to investing in Medicaid’s home- and community-based services to ensure more older Americans and people with disabilities have access to care in their own homes and communities.

The Inflation Reduction Act Supports LGBTQI+ Seniors. The $2,000 cap on prescription drug prices for Medicare enrollees helps LGBTQI+ seniors on Medicare, who typically suffer more from poorer health and poverty. Medication costs are a frequent barrier to managing chronic health issues. 23 percent of the LGBTQI+ community lived in poverty in 2020, compared to 16 percent of their heterosexual counterparts. When looking at further dimensions of intersectionality, members of LGBTQI+ communities of color also disproportionately faced higher rates of poverty than heterosexual members of these communities. A 2021 study found that members of sexual minority communities are more likely than heterosexual individuals to engage in behaviors to reduce the cost of medicine such as skipping doses, trying alternate therapies, or delaying refills.

Biden-Harris Administration Is Defending Transgender Americans

Supporting Gender Affirming Care. On a state-by-state basis, the Center for Medicare and Medicaid Services is approving efforts to expand gender-affirming care under the ACA and other federal programs. HHS has also created a website and resources for LGBTQI+ youth, parents, and providers, on LGBTQI+ health and well-being and gender-affirming care.

Protecting Transgender Youth Mental Health. The Biden Administration is focusing on providing mental health support, creating a more welcoming environment in public schools, and acknowledging the positive impacts of gender-affirming care. President Biden signed the Executive Order on Advancing Equality LGBTQI+ Individuals in June 2022 to defend the rights and safety of LGBTQI+ individuals by directing relevant agencies to discredit conversion therapy, ensuring that federal benefit programs can be equitably accessed by LGBTQI+ households, and increasing federal support for family counseling to reduce the risk of family rejection of LGBTQI+ youth. The Substance Abuse and Mental Health Services Administration is also piloting additional dedicated services for LGBTQI+ youth in the national 988 Suicide and Crisis Lifeline. In February 2024, the Biden-Harris Administration dedicated $5.1 million to fund family counseling and support for LGBTQI+ youth and their families. The goal of this grant is to prevent health risks including suicide, depression, homelessness, and drug use, while also promoting wellness.

Stepping In When States Fail. In honor of Transgender Visibility Day in March 2022, the Justice Department issued a letter to all state attorneys general reinforcing federal transgender youth protections against discrimination and obtaining gender-affirming care. Due to the increase in anti-trans state legislation, the Department of Justice has also filed statements of interest and amicus briefs supporting legal action against state laws that restrict the rights of transgender youth.

Republicans Are Pulling Medications They Don’t Like From The Market – Setting a Dangerous Precedent for LGBTQI+ Care

A Trump-Appointed Judge Is Working To Curb Access To Safe, Affordable Abortions. In April 2023, another Trump-appointed judge ruled against the FDA in a case seeking to remove a popular medication used to induce abortion from the market. Medication abortions are the most common, least expensive, and most accessible method for people to terminate pregnancy and the ruling impacts communities that already have difficulty accessing these key services.

Republicans Want to Pull Medications They Don’t Like Off The Shelves. The case could set a dangerous precedent for any federal judge to pull controversial medications off the market, regardless of the science behind approval decisions or the bureaucratic steps taken to prove safety and efficacy. As Lambda Legal has pointed out, “The trial court’s approach just as easily (or perhaps more easily) could be aimed at HIV-related medications and puberty blockers and hormone treatments, as well as medications for many other health conditions that are specially relevant for our communities.”

Republicans Are Taking Away No-Cost Preventive Care From LGBTQI+ People and Communities of Color

Republicans Are Curbing Access To No-Cost Preventive Services, Disproportionately Impacting LGBTQI+ People and Communities of Color. In March 2023, a Trump-appointed judge decided against the federal government in Braidwood v. Becerra and struck down a major portion of the ACA requiring no-cost coverage of lifesaving preventive health care services recommended by the U.S. Preventive Services Task Force, including lung and breast cancer screenings, Hepatitis C screenings, HIV screenings, and PrEP medication. These changes have a disproportionate impact on historically marginalized populations like LGBTQI+ people and communities of color — curbing no-cost access to preventive services would create barriers to seeking needed care and exacerbate existing health disparities.

Republicans Are Targeting PrEP, A Key Prevention Strategy For HIV. The Trump-appointed judge’s ruling struck down a portion of the ACA guaranteeing access to pre-exposure prophylaxis (PrEP), a drug proven to substantially reduce the risk of contracting HIV. PrEP has been associated with a significant decrease in the number of new HIV diagnoses. PrEP is shown to lower the risk of infection from sex by more than 90 percent (more than 99 percent effective) and is widely viewed as a key prevention strategy for ending the HIV epidemic in the U.S. Thanks to ACA protections, the percentage of PrEP users has jumped from 3 percent of eligible patients in 2015 to 30 percent of eligible patients prescribed in 2021. The federal government’s 2022-2025 strategy to combat HIV recognized gay and bisexual men—particularly Black, Hispanic/Latino, and Native American men—Black women, and trans women as priority populations. Rural populations, especially gay and bisexual Native American men and Two-Spirit populations, have greater difficulty accessing preventive care for HIV.

- Ending ACA PrEP Protections Disproportionately Harms Black and Hispanic/Latino Gay and Bisexual Men. While 66 percent of eligible white people in America are prescribed PrEP, just 16 percent of eligible Hispanic/Latino Americans and 9 percent of eligible Black Americans are prescribed the lifesaving drug. Academic experts have concluded that Braidwood will disproportionately impact racial and ethnic sociodemographic groups at particularly high risk for HIV infection: “Even in our ‘best-case’ scenario, the predominant burden of new restrictions on access to PrEP will likely fall on Black and Latino gay and bisexual men, as well as transgender women, who already face significant barriers to HIV prevention and care.”

Ending ACA Cost-Sharing Protections Could Increase HIV Transmission By At Least 17 Percent In The First Year Alone. According to academic experts, ending the prohibition of cost sharing for PrEP will increase HIV transmission among men who have sex with men by at least 17 percent in the first year alone. Researchers at Yale have already determined that the Braidwood ruling could see coverage for PrEP drop from 28 percent to only 10 percent, mainly due to the fact that 80 percent of PrEP users are on commercial plans that would now have the ability to refuse to cover PrEP. A recent study found that PrEP medication costs nearly $350 for a 30-day supply on average. Outside of the cost of obtaining medication, PrEP users incur additional required charges as part of the care regimen like clinical visits and lab costs that can add up to thousands of dollars annually.

Republicans Are Pushing An Anti-Trans Agenda

10 Republican-Led States Continue To Block Medicaid Expansion, Which Serves Millions Of LGBTQI+ Patients. Republicans in 10 states continue to block Medicaid expansion, while the program provides critical health care access for an estimated 1.2 million LGBTQI+ adults, disproportionately trans and non-binary Black, Hispanic/Latino, Pacific Islander, and Native American people. LGB individuals are more likely to qualify for Medicaid based on income, and Medicaid covers about 21 percent of trans and non-binary people in the U.S.

Republicans Are Waging War On Trans People and Their Health Care. Across the country, Republicans have escalated their war on trans people and health. As of May 2023, 16 Republican-led states have enacted new anti-trans health care laws and 22 states have passed anti-trans health care bills in at least one Republican-held legislative chamber. Republicans have re-centered their culture wars around trans people, with new legislation prohibiting drag shows from public property alongside bans on gender-affirming care. Anti-trans laws contribute to negative health impacts, including an increased risk of suicidality and substance use among trans and non-binary youths. Equitable access to health care services has always been a challenge for LGBTQI+ people. A 2018 survey found that 75 percent of people seeking gender-identity-based care have had negative experiences during physician visits. The fight to get insurers to cover basic care for trans patients—let alone gender-affirming care—has been a grueling, decades-long process even with ACA protections and federal and state-level enforcement. New bans threaten to undo decades of work to provide trans people with access to affordable, gender-affirming care.