The fact of the matter is simple: association health plans (AHPs) are not required to cover the essential health benefits put in place by the Affordable Care Act and are allowed to charge people more based on their age, health status, and gender. This means that while AHPs are required to cover people with pre-existing conditions, they can refuse to cover any treatment associated with a pre-existing condition. Because these plans lack consumer protections, plans that do cover essential health benefits could scale back coverage at some point, and consumers wouldn’t know until it was too late. Fundamentally, association health plans open the door to coverage that is not comprehensive and have a long, well-documented history of fraud and abuse.

ASSOCIATION HEALTH PLANS HAVE A HISTORY OF FRAUD AND UNPAID CLAIMS

Former Insurance Fraud Investigator: “Fraudulent Association Health Plans Have Left Hundreds Of Thousands Of People With Unpaid Claims.” “Marc I. Machiz, who investigated insurance fraud as a Labor Department lawyer for more than 20 years, said the executive order was ‘summoning back demons from the deep.’ ‘Fraudulent association health plans have left hundreds of thousands of people with unpaid claims,’ he said. ‘They operate in a regulatory never-never land between the Department of Labor and state insurance regulators.’” [New York Times, 10/21/17]

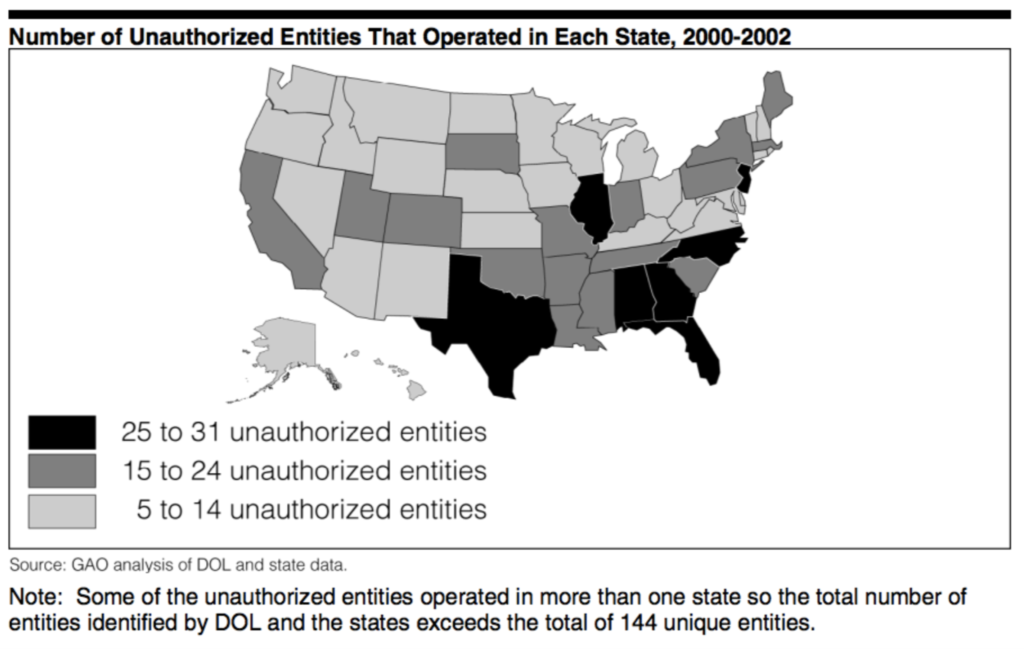

Between 2000 and 2002, AHPs Left 200,000 Policyholders with $252 Million In Unpaid Medical Bills. “There have been several documented cycles of large-scale scams. According to the GAO, between 1988 and 1991, multiple employer entities left 400,000 people with medical bills exceeding $123 million. The most recent cycle was between 2000 and 2002, as 144 entities left 200,000 policyholders with $252 million in unpaid medical bills.” [United Hospital Fund, 3/6/18]

[GAO, February 2004]

2017: Labor Department Filed A Suit Against An AHP For 300 Employers In Washington State Alleging The AHP Had Charged Employers More Than $3 Million In Excessive Fees And Violating Its Fiduciary Duty By Using Assets For Personal Interests. “The problems are described in dozens of court cases and enforcement actions taken over more than a decade by federal and state officials who regulate the type of plans Mr. Trump is encouraging, known as association health plans. In many cases, the Labor Department said, it has targeted ‘unscrupulous promoters who sell the promise of inexpensive health benefit insurance, but default on their obligations.’ In several cases, it has found that people managing these health plans diverted premiums to their personal use. The department filed suit this year against an association health plan for 300 small employers in Washington State, asserting that its officers had mismanaged the plan’s assets and charged employers more than $3 million in excessive ‘administrative fees.’ Operators of the health plan violated their fiduciary duty by using its assets ‘in their own interest,’ rather than for the benefit of workers, the government said.” [New York Times, 10/21/17]

2016: A Labor Department Lawsuit Revealed An AHP Had Concealed Financial Problems And Left $3.6 Million In Unpaid Claims. “The Labor Department filed suit last year against a Florida woman and her company to recover $1.2 million that it said had been improperly diverted from a health plan serving dozens of employers. The defendants concealed the plan’s financial problems from plan participants and left more than $3.6 million in unpaid claims, the department said in court papers.” [New York Times, 10/21/17]

A Health Plan For New Jersey Small Businesses Collapsed With $7 Million In Unpaid Claims. “In another case, a federal appeals court found that a health plan for small businesses in New Jersey was ‘aggressively marketed but inadequately funded.’ The plan collapsed with more than $7 million in unpaid claims.” [New York Times, 10/21/17]

In Florida, A Man Pleaded Guilty To Embezzling $700,000 In Premiums From An AHP To Help Build A Home For Himself And Was Sentenced To 57 Months In Prison. “A Florida man was sentenced to 57 months in prison after he pleaded guilty to embezzling about $700,000 in premiums from a health plan that he had marketed to small businesses. The Labor Department and the Justice Department said he had used some of the plan premiums to build a home for himself.” [New York Times, 10/21/17]

In South Carolina, A Man Pleaded Guilty To Diverting Nearly $1 Million From An AHP For Churches And Small Businesses, Leaving $1.7 Million In Unpaid Claims. “A South Carolina man pleaded guilty after the government found that he had diverted more than $970,000 in insurance premiums from a health plan for churches and small businesses. ‘His embezzlement and the plan’s consequent failure left behind approximately $1.7 million in unpaid medical claims,’ the Labor Department said.” [New York Times, 10/21/17]

In Louisiana, Two People Pleaded Guilty To Using Money From The AHP For Spa Treatments, Diamond Cuff Links, Foreign Travel And Other Personal Expenses. “And in Louisiana, two people pleaded guilty to conspiracy charges after the government found that they had taken money from the medical benefit fund of a trade association and used it to pay for spa treatments, diamond cuff links, evening gowns, foreign travel and other personal expenses.” [New York Times, 10/21/17]

One AHP Scheme Shows How AHPs Can Move From State To State. Families USA chronicled an AHP scheme involving the American Trade Association, Smart Data Solutions, and Serve America Assurance. They found:

- “Even after one state identifies a problem, the company may continue to operate for years in other states. North Carolina issued a cease and desist order to stop many of the players in this case from selling insurance in 2008.”

- “But by June 2010, when Maryland issued a cease and desist order, the plans sold by these players had been identified in at least 23 states.2 Estimates of total premiums paid to these companies for unauthorized, unlicensed plans range from $14 million to $100 million.”

- “This particular scheme operated through associations that went by many different names. (At least one of the players in this case was involved in a previous case concerned with fraudulent insurance sold through an association of employers in 2001-2002.”

- “Consumers are often ill-protected when they buy coverage through an association, and the web of relationships among salespeople, associations, administrators, and actual insurers can be difficult for regulators to unravel and oversee. Consumers may be encouraged to join fake associations to buy health insurance so they have an illusion of coverage—and the insurers collect membership dues and premiums while illegally avoiding state oversight).” [Families USA, October 2010]

GAO Report In 1992 Showed Similar AHPs Left At Least 398,000 Participants With More Than $123 Million In Unpaid Claims And More Than 600 Plans In Almost Every State Failed To Comply With State Laws. “Back in 1992, the Government Accountability Office issued a scathing report on these multiple employer welfare arrangements (known as MEWAs; they’re pronounced “mee-wahs”) in which small businesses could pool funds to get the lower-cost insurance typically available only to large employers. These MEWAs, said the government, left at least 398,000 participants and their beneficiaries with more than $123 million in unpaid claims between January 1988 and June 1991. Furthermore, states reported massive and widespread problems with MEWAs. More than 600 plans in nearly every U.S. state failed to comply with insurance laws. Thirty-three states said enrollees were sometimes left without health coverage when MEWAs disbanded…’MEWAs have proven to be a source of regulatory confusion, enforcement problems and, in some instances, fraud,’ the GAO wrote at the time.” [Washington Post, 10/12/17]

Kentucky Experiment Showed AHPs Destabilize The Market And Caused Insurers To Leave Individual Market Or Not Sell New Policies Subject To Higher Standards. “In 1994, Kentucky passed a set of health insurance reforms (for the individual and small-group markets) that were very similar to the ACA’s market reforms. These included a requirement for insurers to accept all applicants regardless of their health status, restrictions on exclusions of pre-existing health conditions, and a requirement that premiums be set without regard to health status, claims experience, or gender. Premium variations for age, family size, and geographic factors were limited, and plan benefits were standardized. Insurers in the state resisted the reforms and lobbied to repeal parts of it. In 1996, Kentucky’s legislature passed legislation that repealed many of the market reforms. Crucially, the law exempted associations of employers or individuals from the premium-rating and benefits requirements, a loophole that allowed associations to sell coverage under a much weaker regulatory scheme. In part because healthy individuals could buy association plans, the risk of adverse selection against the reformed individual market increased. Nearly all insurers left Kentucky’s individual market or declined to sell new policies that were subject to the stronger rating and benefits standards. In 1998, the Kentucky legislature passed a bill that repealed many of the state’s remaining health insurance reforms.” [Center on Budget and Policy Priorities, 11/29/17]

STATE INSURANCE OFFICIALS, EXPERTS HAVE WARNED OF SUCH FRAUD UNDER NEW RULES

As Coalition Urges States To Allow AHPs, State Officials Push Back, Warn Of Fraud. “A coalition of business groups wants to ensure that the states aren’t setting up hurdles that will make it difficult for small employers to participate in group health plans established under a new rule by the U.S. Labor Department… [Pennsylvania Insurance Commissioner Jessica Altman] reminded the DOL before the rule was finalized about the history of fraud among past association health plans. She wasn’t the only official in Pennsylvania to oppose the plans. Attorney General Josh Shapiro also pushed back against the rule, joining 11 other attorneys general in a lawsuit against the DOL and the U.S.” [Bloomberg, 9/11/18]

State Insurance Commissioners Want To Know What Restrictions They Can Put On AHPs. “But given the looming sales of AHPs, state regulators want to know as soon as possible what restrictions they can place on the plans. They fear the Trump administration may argue that state regulation is pre-empted by the federal Employee Retirement Income Security Act, which governs self-insured employer health plans…The states that so far have issued new rules or policy statements limiting AHPs are Democratic-led states. But insurance regulators in both red and blue states are nervous about an expansion of AHPs given the long history of fraud and insolvencies involving these types of plans.” [Modern Healthcare, 8/7/18]

Dr. James Madara, CEO of the American Medical Association: Association Health Plans Have Potential To Threaten Health And Financial Stability. “Fraudsters prey upon areas of regulatory ambiguity and may challenge such authority in courts to further delay enforcement, which allows more time to increase unpaid medical claims…Without proper oversight to account for insolvency and fraud, AHPs have the potential to … (threaten) patients’ health and financial security and the financial stability of physician practices and other providers.” [Modern Healthcare, 3/7/18]

Insurance Commissioners Have Had Difficulty Finding Answers On The Ground About Association HealthPlans.“‘We’re asking questions and finding it very difficult to get answers,’ said Washington state Insurance Commissioner Mike Kreidler.” [Politico, 8/6/18]

ASSOCIATION HEALTH PLANS DON’T HAVE TO OFFER COMPREHENSIVE COVERAGE

Katherine Hempstead, Robert Wood Johnson Foundation: “The Easier You Make It Not To Buy Comprehensive Coverage, The Harder You Make It Buy Comprehensive Coverage.” [New York Times, 10/11/17]

Vox: Association Health Plans Could Allow Groups To Act As Large Employers Which Do Not Have To Cover Essential Benefits Under The ACA. “The result could in many cases be that these new association health plans would be considered large employers when it comes to health insurance. Large employers are not subject to the same rules as individual or small-group plans under Obamacare. Most notably, they do not have to cover all of the law’s essential health benefits or meet the requirement that insurance cover a minimal percentage of a person’s medical bills.” [Vox, 10/12/17]

Treating Association Health Plans Like Large Employers Would Exempt Them From Guaranteeing Essential Health Benefits And Allow Them To Charge People Based On Health Status And Gender. Treating Association Health Plans like large-employers would exempt them from key consumer protections under the Affordable Care Act. Large employers do not have to offer plans with the Essential Health Benefits like maternity care, prescription drug coverage or mental health and substance abuse services. Insurers for large employers can also charge more based on health status and gender. [Georgetown Center on Health Insurance Reforms, December 2017]