SHORT-TERM JUNK PLANS OFFER INADEQUATE MEDICAL COVERAGE AND CIRCUMVENT FUNDAMENTAL CONSUMER PROTECTIONS

Short-Term Plans May Exclude Coverage For Pre-Existing Conditions. “Policyholders who get sick may be investigated by the insurer to determine whether the newly-diagnosed condition could be considered pre-existing and so excluded from coverage.” [Kaiser Family Foundation, 2/9/18]

- As Many As 130 Million Nonelderly Americans Have A Pre-Existing Condition. [Center for American Progress, 4/5/17]

- 1 in 4 Children Would Be Impacted If Insurance Companies Could Deny Or Charge More Because Of A Pre-Existing Condition. [Center for American Progress, 4/5/17]

Short-Term Junk Plans Can Refuse To Cover Essential Health Benefits. “Typical short-term policies do not cover maternity care, prescription drugs, mental health care, preventive care, and other essential benefits, and may limit coverage in other ways.” [Kaiser Family Foundation, 2/9/18]

Under Many Short-Term Junk Plans, Benefits Are Capped At $1 Million Or Less. Short-term plans can impose lifetime and annual limits – “for example, many policies cap covered benefits at $1 million or less.” [Kaiser Family Foundation, 2/9/18]

Commonwealth Fund: “Cost Sharing Designs In Short-Term Coverage Leave Members Facing Major, Unpredictable Financial Risk.” “The out-of-pocket maximum for each best-selling plan is higher than that allowed in individual or employer plans under the ACA, when adjusting for the shorter plan duration. When considering the deductible, the best-selling plans have out-of-pocket maximums ranging from $7,000 to $20,000 for just three months of coverage. In comparison, the ACA limits out-of-pocket maximums to $7,150 for the entire year.” [Commonwealth Fund, 8/11/17]

Short-Term Junk Plans Can Retroactively Cancel Coverage After Patients File Claims. “Individuals in STLDI plans would be at risk for rescission. Rescissions are retroactive cancellations of coverage, often occurring after individuals file claims due to medical necessity. While enrollees in ACA coverage cannot have their policy retroactively cancelled, enrollees in STLDI plans can.” [Wakely/ACAP, April 2018]

Short-Term Junk Plan Currently Being Sold In Thirteen States Does Not Cover Services For Patients Admitted To Hospital On The Weekend. “That brings us to the short-term plan marketed by UnitedHealth’s Golden Rule subsidiary….To begin with, the Golden Rule plan excludes pregnancy and provides for a lifetime maximum benefit of only $250,000. Remarkably, it won’t cover hospital room, board or nursing services for patients admitted to a hospital on a Friday or Saturday, unless for an emergency or for necessary surgery the next day.” [Los Angeles Times, 4/26/18]

JUNK COVERAGE PROVIDED BY SHORT-TERM PLANS LEAVES THOSE WHO GET SICK WITH THOUSANDS OF DOLLARS IN UNPAID BILLS

Atlanta Woman With Short-Term Plan Was Diagnosed With Cancer And Left With $400,000 Medical Bill. “Dawn Jones…bought a short-term plan from Golden Rule Insurance, a unit of UnitedHealth Group Inc., so she’d be covered between jobs, according to court documents. Then, she was diagnosed with breast cancer. Despite showing evidence she was unaware of the cancer when she bought the policy, the insurer didn’t pay for Jones’s treatment, leaving her with a $400,000 medical bill, according to a complaint she filed against the company in September 2016… the judge sided with Golden Rule and dismissed the case in August, finding the policy agreement clearly stated that preexisting conditions wouldn’t be covered, even if the customer was unaware of the condition. Jones wasn’t diagnosed until after she bought her policy.” [Bloomberg, 10/17/17]

San Antonio Man Paid Premiums To Short-Term Plan Company For Six Years, And Was Denied Coverage When He Developed Kidney Disease. “Pat’s decision to save some money by buying short-term insurance was a big mistake, says Karen Pollitz, project director of Georgetown University’s Health Policy Institute and a leading expert on the individual-insurance market. ‘These short-term policies are a joke,’ she says. ‘Nobody should ever buy them. It is false security that is being sold. It’s junk.’ That’s because diagnosing and treating an illness may not fall neatly into six-month increments. While Pat had been continuously covered since 2002 by the same company, Assurant Health, each successive policy treated him as a brand-new customer. In looking back over Pat’s medical records, the company noticed test results from December, eight months earlier. Though Pat’s doctors didn’t determine the precise cause of the problem until the following July, his kidney disease was nonetheless judged a ‘pre-existing condition’ — meaning his insurance wouldn’t cover it, since he was now under a different six-month policy from the one he had when he got those first tests.” [Time, 3/5/09]

In San Francisco, Woman Was Hit With $150,000 Charge After Short-Term Health Plan Refused Coverage. “Grace Wood, an instructor at a university in San Francisco, bought a short-term plan in 2013. When she had to have a heart procedure, her insurer, HCC Life, balked, leaving her with roughly $150,000 in unpaid medical bills.” [New York Times, 11/30/17]

Short-Term Insurance Plan Refuses To Pay For Man’s Triple Bypass Surgery, Leaving Family With $900,000 In Bills. “One case pending in federal court involves Kevin Conroy, who had a heart attack in 2014 and underwent triple bypass surgery, just two months after his wife, Linda, obtained a short-term policy over the telephone. Their insurer, HHC Life, refused to pay the bills. ‘We freaked out,’ Ms. Conroy said. ‘What were we going to do? It was $900,000.’ The insurer informed the Conroys the policy was ‘rescinded,’ to use the industry jargon. “[New York Times, 11/30/17]

SUBPAR COVERAGE OFFERED BY SHORT-TERM PLANS RAISES HEALTH COSTS FOR CONSUMERS WHILE RAKING IN PROFITS FOR INSURANCE COMPANIES

Short-Term Health Plans Rake In Profits For Insurance Companies While Leaving Consumers Unprotected. “That’s why they make up such a high-profit portion of the insurance industry: They are largely designed to rake in premiums, even as they offer little in return. And even when they do pay for things, they often provide confusing or conflicting protocols for making claims. Collectively, short-term plans can leave thousands of people functionally uninsured or underinsured without addressing or lowering real systemwide costs.” [The Atlantic, 4/25/18]

More Premium Dollars Can Go Toward Profit, Rather Than Coverage With Short-Term Plans. Short-term plans do not have to follow the Medical Loss Ratio, meaning that more premium dollars gan go toward administration and profit than under other plans. For instance, the largest seller of short-term insurance only requires 50% of premium dollars to pay for medical coverage, much less than the 80% required by ACA-compliant plans. [Wakely/ACAP, April 2018]

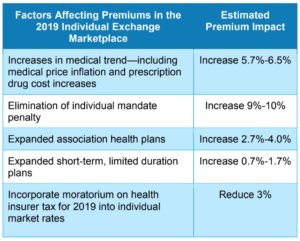

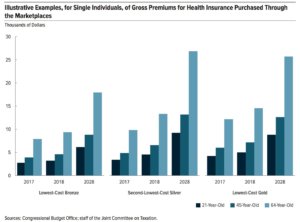

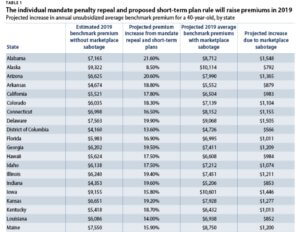

Junk Plans Lead To Higher Premiums For Those Enrolled In Full Coverage Plans. “While recent state-level and federal proposals differ in the details, they’d have a similar result: People who buy skimpy plans would face staggering costs when they get sick, and consumers who want comprehensive coverage could face drastic premium increases.” [Center on Budget and Policy Priorities, 2/5/18]

Short-Term Plans Divide Insurance Market Between Sick And Healthy. “Because short-term plans are not considered individual market coverage that must meet ACA standards, they can, and typically do, exclude coverage of pre-existing medical conditions, limit the amount of benefits that a person can receive from the plan in a year, and fail to include many of the essential health benefits, such as maternity care, mental health and substance-use disorder services, and prescription drugs…Short-term plans would be most likely to attract healthier people, leading to premium increases for ACA-compliant plans and destabilizing individual insurance markets across the nation.” [Center on Budget and Policy Priorities, 11/29/17]

Junk Plans Mean Higher Premiums For People With Pre-Existing Conditions. “By promoting short-term policies, the administration is making a trade-off: lower premiums and less coverage for healthy people, and higher premiums for people with preexisting conditions who need more comprehensive coverage.” [Washington Post, 5/1/18]

JUNK PLANS DESTABILIZE THE INDIVIDUAL MARKET, DRIVING UP COSTS FOR MIDDLE CLASS FAMILIES

Gary Claxton, Kaiser Family Foundation Vice President: Short-Term Plans “Draw In Healthy People And Spit Them Back Into The Marketplace When They’re Sick.” “Short-term health plans, meanwhile, have the ability to charge sick people more than healthy people, to deny people with preexisting conditions, and kick people off the plans if they get sick. If federal agencies decided to lift the limits on the short-term plans, and to exempt people on them from the penalty for not buying health insurance, Obamacare’s individual market could become destabilized, Claxton says. Healthy people would join the short-term plans when they were healthy, stay on them for a year, and pay little for skimpier coverage. If they got sick, they would be kicked off those plans and onto the Obamacare exchanges, where coverage is expansive but prices would be higher than they are now.” [The Atlantic, 10/12/17]

Tim Jost, Health Law Expert: Short Term Health Plans Provide Subpar Coverage and Destabilize Market. “As their name suggests, short-term plans provide coverage for a limited period of time, often six months or less. They generally don’t cover such things as preexisting conditions, maternity services or prescription drugs. The policies typically have maximum coverage limits of about $1 million. Insurers can turn people down if they’re sick and may decide not to renew someone’s policy… ‘The big health insurance companies are really mixed on this,’ said Timothy Jost, emeritus professor at Washington and Lee University School of Law and an expert on the health law. ‘They see this as a seriously destabilizing force in the market, this crap coverage.’” [Kaiser Health News, 1/31/17]

When Healthy Individuals Opt For Short-Term Plans, Costs Go Up For Those Who Are Sick. “To the extent that healthy individuals opt for cheaper short-term policies instead of ACA-compliant plans, such adverse selection contributes to instability in the reformed non-group market and raises the cost of coverage for people who have health conditions.” [Kaiser Family Foundation, 2/9/18]

Larry Levitt, Kaiser Family Foundation Senior Vice President: Short-Term Plans Will Raise Premiums for Middle Class Families. “‘The repeal of the mandate and expansion of association health plans and the rise of short-term plans will certainly send premiums rising for middle-class people with pre-existing conditions whose only option is the [ObamaCare]-regulated market,’ said Larry Levitt, a vice president at the Kaiser Family Foundation.” [The Hill, 1/7/18]

KEY HEALTH INSURANCE STAKEHOLDERS WARN AGAINST SHORT-TERM PLANS

98 Percent Of Health Groups That Submitted Comments To HHS Have Serious Concerns About The Short-Term Proposal. “More than 98% — or 335 of 340 — of the healthcare groups that commented on the proposal to loosen restrictions on short-term health plans criticized it, in many cases warning that the rule could gravely hurt sick patients.” [Los Angeles Times, 5/30/18]

American Cancer Society Cancer Action Network: “Health Care Changes Could Leave Millions Of Cancer Patients And Survivors Unable To Access Meaningful Coverage.” “Today’s executive order jeopardizes the ability of millions of cancer patients, survivors and those at risk for the disease from being able to access or afford meaningful health insurance. Exempting an entire set of health plans from covering essential health benefits like prescription drugs or specialty care and allowing expansion and renewability of bare-bones short-term plans will split the insurance market. If younger and healthier people leave the market, people with serious illnesses like cancer will be left facing higher and higher premiums with few, if any, insurance choices. Moreover, those who purchase cheap plans are likely to discover their coverage is inadequate when an unexpected health crisis happens leaving them financially devastated and costing the health care system more overall.” [ACS CAN, 10/12/17]

Blue Cross Blue Shield Officials Worry Short-Term Health Plans “Could Really Weaken The Efforts To Stabilize The Marketplace.” “Short-term plans can turn away people with pre-existing conditions, place caps on how much they’ll cover, and decline to cover services like maternity care. All of which means they could siphon healthy consumers out of the ACA’s marketplaces. ‘It could really weaken the efforts to stabilize the marketplace,’ says Kris Haltmeyer, BCBSA’s vice president of legislative and regulatory policy.” [Axios, 2/6/18]

American Academy of Family Physicians: STLD Plans Would Destabilize Individual Market. “We are troubled by how the proposed rule would further destabilize the individual market by drawing young, healthy people away from meaningful, comprehensive coverage…under the proposed rule, insurers could reduce or eliminate certain EHBs to avoid vulnerable, expensive patients by excluding specific services.” [Letter to HHS, 4/18/18]

ACS CAN: Short-Term Plans Are Exempt From Important Consumer Protections. “We are very concerned about policies that would expand access to STLD policies because these products are exempt from important consumer protections, such as prohibitions on lifetime and annual dollar limits, limits on the use of pre-existing condition exclusions, and the prohibition on medical underwriting…We are afraid that some consumers choose to enroll in STLD policies simply because of the lower premium and are unaware of the limitations of the coverage.” [ACS CAN letter to HHS, 4/20/18]

Alliance of Community Health Plans: Concerned It Will Leave Consumers With Fewer Coverage Options “ACHP is also concerned that the proposed rule will cause more insurers to flee the market, leaving consumers with fewer coverage options.” [Letter to HHS, 4/19/18]

American College of Rheumatology: Short-Term Plans Will Hurt Patients With Rheumatoid Arthritis. “We urge the agencies to consider how healthy individuals leaving the exchanges to purchase STLDI plans would affect market stability and premiums for those still in the health exchange. Potentially, our patients with diseases such as rheumatoid arthritis could see an upward swing in their premiums, causing further affordability and access issues” [American College of Rheumatology, 4/23/18]

AHIP: Short-Term Plans Should Not Be Offered As Replacement For Comprehensive Coverage. “‘We recommend that short-term plans should not be offered as a full replacement for comprehensive coverage,’ AHIP says — because that could pull healthy customers out of the market for ACA coverage.” [Axios, 4/23/18]

Dr. David O. Barbe, president of American Medical Association: These Plans Would Result In “Inadequate Health Insurance Coverage.” “We believe the proposed rule, however, would culminate in plans being offered that fall far short of maintaining crucial state and federal patient protections, disrupt and destabilize the individual health insurance markets, and result in substandard, inadequate health insurance coverage.” [Forbes, 4/22/18]

Margaret Murray, CEO of Association for Community Affiliated Plans: Short Term Plans “strip every provision that might be of value to a patient.” “Not only do STLDI plans not cover pre-existing conditions, but what was covered when you bought the plan can be excluded three months later when you try to renew the plan. Rescissions are rampant in the STLDI market, leading to retroactive cancellation of policies that stick patients with enormous medical bills.” [Washington Examiner, 4/26/18]

Mario Molina, Former CEO of Molina Healthcare: Hopefully You Already Had Kids, Because Short-Term Plans Gut Maternity Care. “Hopefully, you had kids already, because under the short-term health plan expansion encouraged by an executive order signed last year, covered maternity care vanishes in 100% of plans analyzed by [the Kaiser Family Foundation]” [Mario Molina, 4/23/18]

California Department Of Insurance: “Trump Executive Order Will Create A Health Insurance Race To The Bottom.” “Increased sale of short-term policies that don’t cover essential health care needs or comply with most rules that apply to health insurance will harm consumers and create health insurance market instability.” [CDI, 10/12/17]

Sandy Praeger, Former Republican State Insurance Regulator In Kansas And Onetime President Of National Association Of Insurance Commissioners: “Basically anybody who knows anything about healthcare is opposed to these proposals.” [Los Angeles Times, 5/30/18]