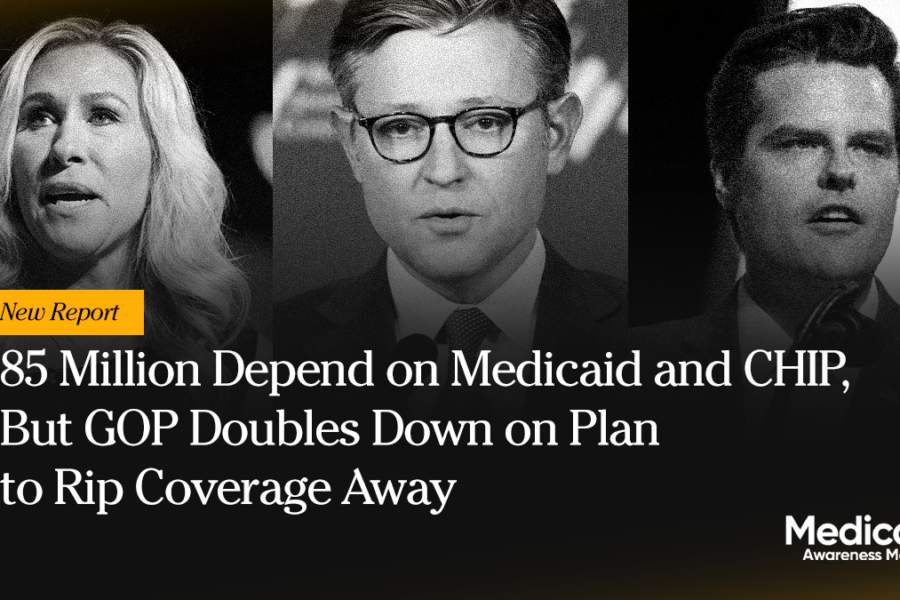

NEW REPORT: Medicaid Coverage Is at Risk for Millions in the Asian American, Native Hawaiian, and Pacific Islander Community

The GOP Scheme Will Raise Costs and Rip Coverage Away from AANPHI Communities Read the…

ashoupMay 30, 2025