After USA Today reported that Senate health care stabilization negotiators are discussing bringing back high-risk pools, Protect Our Care is releasing a fact sheet detailing why this approach won’t work, as well as a statement from Protect Our Care Campaign Director Brad Woodhouse:

“Health care advocates continue to call for a bipartisan stabilization package to address the individual insurance market damage being caused by Trump Administration sabotage. Any serious proposal must reject bringing back high-risk pools, failed experiments that segregate sick people in worse coverage and that would further destabilize the markets.

“It’s time for Congressional Republicans to reject the partisan war on health care, stop pushing proposals that hurt people with pre-existing conditions, and start working with Democrats to come up with real solutions that bring down health care costs for American families.”

FACT SHEET: EVIDENCE SHOWS HIGH RISK POOLS ARE THE WRONG ANSWER

Stabilization Negotiators Must Reject Higher Costs & Coverage Restrictions for People With Pre-Existing Conditions

As Congressional negotiators consider health care stabilization proposals to include in next month’s Omnibus, overwhelming evidence shows that high-risk pools are one idea they should take off the table. This is a tool that has been tried and failed. Here’s why high risk pools would make challenges in American health care worse, not better:

HIGH RISK POOLS IMPOSE HIGH PREMIUMS & DEDUCTIBLES …

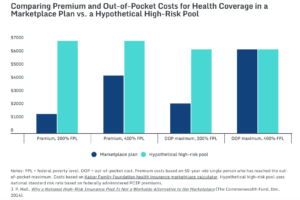

Premiums For Coverage In High Risk Pools Were As Much As 200 Percent Higher Than The Average Rate But Covered Less Care. “High-risk pool enrollees faced substantially higher premiums than people in the normal individual market, often by as much as 150 percent to 200 percent, although some pools did offer subsidies to low-income enrollees…And stunningly, the overwhelming majority of state high-risk pools actually refused to pay for services associated with a patient’s pre-existing conditions in the first months of their enrollment.” [Center for American Progress, 2/16/17]

Deductibles For High Risk Pool Enrollees Were Well Above Maximum Allowed By ACA. ”Fourteen states had plans with deductibles of $10,000 per year or higher, substantially greater than the current maximum $7,150 deductible for catastrophic plans in the marketplaces. Thirty states imposed maximum lifetime limits; others had annual coverage limits as low as $75,000 per year.” [Commonwealth Fund, 3/29/17]

Source: Commonwealth Fund, 3/24/17

… COST TAXPAYERS MORE …

Despite High Premiums, High Risk Pools Could Still Cost The American People Over $90 Billion Annually. “The U.S. Department of Health and Human Services (HHS) recently estimated that up to 17,875,000 people with preexisting conditions were uninsured in 2010. Had all of them been covered by high-risk pools, the cost would have been $194.8 billion in 2010 dollars, with premiums covering only $103.3 billion. Thus, states and the federal government would have needed to find $91.5 billion in additional funding to cover them all—much more than the up to $10 billion per year in federal assistance to states recently proposed by congressional Republicans.” [Commonwealth Fund, 3/29/17]

An Analysis Of High Risk Pools Under The ACHA Finds Such Pools Would Cost The Government Between $37 and $56 Billion Annually. “Government costs for supporting the high-risk pool using ACA-like coverage and subsidies would range from $37 to $56 billion in 2020 and $437 to $656 billion over 10 years (2020–2029), depending upon the eligibility rules used.” [The Urban Institute, May 2017]

Even Conservatives Estimated High Risk Pools Would Cost $15-$20 Billion Annually. “For comparison, conservative experts James Capretta and Tom Miller have estimated that $15 billion to $20 billion per year, or $150 billion to $200 billion over 10 years, would be needed to fully finance high-risk pools even if they covered only 2 million to 4 million people.” [Center For American Progress, 2/16/17]

Premiums For High Risk Pool Coverage Paid Just 53 Percent Of Program Costs. “Premiums ranged from 125 percent to 200 percent of average premiums in the individual market, yet covered only about 53 percent of claims and administrative costs nationally (Wisconsin allowed premiums up to 200 percent of average).” [Commonwealth Fund, 3/29/17]

… AND RESTRICT COVERAGE

High Risk Pools Typically Had Pre-Existing Condition Exclusions And Limited Benefits. “Many such pools had pre-existing condition exclusion periods, limited benefits, and enrollment limits; all of these characteristics served to reduce the value of the coverage, creating high financial burdens for enrollees and limiting the number of people who could access the coverage.” [Health Affairs, 3/15/16]

Most State High Risk Pools Had Lifetime And Annual Limits On Coverage. “Thirty-three pools [out of 35 states] imposed lifetime dollar limits on covered services, most ranging from $1 million to $2 million. In addition, six pools imposed annual dollar limits on all covered services while 13 others imposed annual dollar limits on specific benefits such as prescription drugs, mental health treatment, or rehabilitation.” [Kaiser Family Foundation, 2/22/17]

High Risk Pools Typically Had Waiting Periods. “There were 35 state high-risk pools before the Affordable Care Act passed. To control costs, they would often do things like charge higher premiums than the individual market. Most had waiting periods before they would pay claims on members’ preexisting conditions, meaning a cancer patient would need to pay premiums for six months or a year before the high-risk pool would cover her chemotherapy treatments.” [Vox, 5/3/17]

High Risk Pools Mean Delayed Or Forgone Care. “Even once they were in a high-risk pool, the high costs and limited benefits prompted some people to delay or forgo care, leading to poorer health outcomes and even more spending. And many families accrued substantial medical debt, even with the coverage.” [Stateline, 2/16/17]

HIGH RISK POOL = MORE PEOPLE UNINSURED

Limited Coverage And High Costs Cause People To Remain Uninsured. “Some patients also delayed care to save money, exacerbating their health conditions, and only entered the pools when their conditions became emergencies.” [Stateline, 2/16/17]

CMS: One-Third Of Uninsurable Were Unable To Afford High Risk Pool Coverage. A 2004-05 study by the Center for Medicare and Medicaid Services found that “nationally, high-risk pool premiums are above 25 percent of family income (i.e., are unaffordable) for 10 percent of all individuals, 18 percent of the uninsured, and 29 percent of the uninsurable. By these standards, almost one-third of the uninsurable are unable to afford high-risk pool coverage…” [CMS, Health Care Financing Review, Winter 2004-2005]

HIGH RISK POOLS HAVE BEEN TRIED & FAILED

California High Risk Pool Led To Waiting Lists, High Premiums, And Lifetime Limits. “For example, California’s high-risk pool imposed a shorter-than-average, three-month waiting period before enrollees could receive treatment for pre-existing conditions—but also imposed a $75,000 annual limit on benefits along with a $750,000 lifetime limit. In addition, the state capped enrollment, resulting in long waiting lists of people unable to enroll; at the same time, the pool’s high premiums proved difficult for enrollees to afford, leading some to drop out.” [Center for American Progress, 2/16/17]

Premiums in Florida’s High Risk Pool Were Twice The Normal Rate. “Many states starved high-risk pools of cash. Florida’s contained only about 200 people in 2011. Premiums were commonly twice the normal rate. Many states had enrolment caps, meaning that even people willing to fork over were not guaranteed coverage.” [The Economist, 1/16/17]

In Wisconsin, “Cancer Doesn’t Wait” For High Risk Pool Waiting Periods. “The benefit waiting periods used by Wisconsin’s and other states’ high-risk pools are a big concern for patient advocates and provider groups. ‘A six-month exclusionary period is a serious issue,’ said Dr. Len Lichtenfeld, deputy chief medical officer for the American Cancer Society, who also testified at the House hearing. ‘Cancer doesn’t wait.’” [Modern Healthcare, 2/13/17]

In Utah, High Risk Pools Were Limited In Size, And Offered Sub-Par, Delayed Coverage. “Stevenson said only 3,000 people signed up for Utah’s risk pool plan while 200,000 Utahns are signed up for insurance through Obamacare. ‘Utah’s past high risk pool plan had many limitations too,’ he said. People with pre-existing conditions had to wait six months before using their coverage. Pregnant women had a 10 month waiting period before they had any coverage for them or their baby. ‘The measure of success for a program is how many people it helps and if you are only covering 3,000 people and leaving tens of thousands uninsured, I don’t think that’s a good thing to go back to,’ he said.” [CBS KUTV, 3/9/17]

High Risk Pools Mean Higher Costs, Higher Uninsured, And Less Coverage. “The reality is that high-risk pool coverage was prohibitively expensive and there is little evidence to suggest that the existence of such pools made coverage less costly for others in the individual insurance market. Without substantially more federal funding than currently proposed, these facts are not likely to change. People with preexisting conditions may have “access” to coverage, but most will not be able to afford it and those who can will face limited benefits and extremely high deductibles and out-of-pocket payments.” [Commonwealth Fund, 3/29/17]